by Tim Hinchcliffe | The Sociable

The finternet will merge into digital public infrastructure where anonymity is abolished, money is programmable & citizens are coerced into compliance: perspective

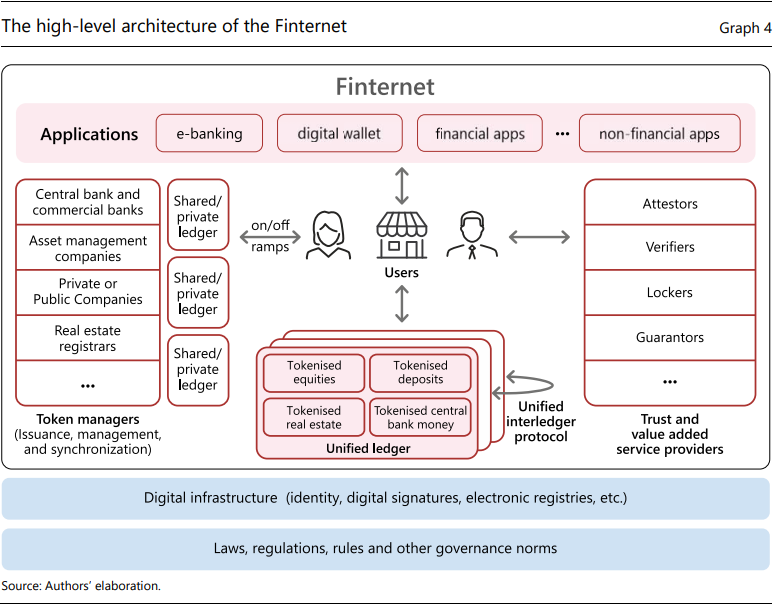

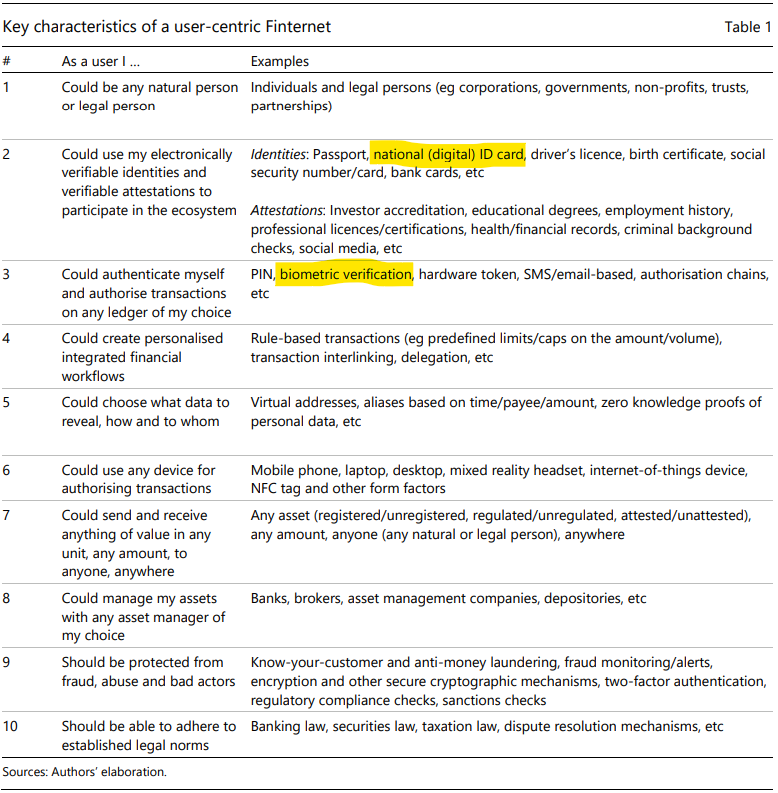

India’s digital identity architect Nandan Nilekani and Bank for International Settlements (BIS) general manager Agustin Carstens propose creating the “finternet,” which they believe will be “the future financial system” powered by digital ID, programmable central bank digital currencies (CBDCs), tokenized deposits, and unified ledgers.

Written by India’s digital identity architect and Infosys co-founder Nandan Nilekani, and BIS managing director Agustin Carstens, the 44-page BIS working paper “Finternet: the financial system for the future” provides a blueprint for how the finternet could connect multiple financial ecosystems through unified, programmable ledgers.

In their introduction, the authors state:

“We propose the concept of the ‘Finternet’ as a vision for the future financial system: multiple financial ecosystems interconnected with each other – much like the internet”

Nandan Nilekani

Agustin Carstens

“The Finternet would be designed to empower individuals and businesses by placing them at the center of their financial lives. Unified ledgers are a promising vehicle to turn this vision into reality”

Source: BIS

“While unified ledgers could in principle contain any financial asset, tokenized money is a core requirement […] Asset programmability would make it possible to embed adherence to relevant rules and regulations within the tokens and transaction instructions in the system”

Bank for International Settlements, “Finternet: the financial system for the future,” April 15, 2024

Unified ledgers, according to the authors, are a promising vehicle to deliver on the three necessary components for a finternet to operate.

Those components include:

- An efficient economic and financial architecture

- The application of cutting-edge digital technology

- A robust legal and governance framework

With unified ledgers being key to a functional finternet, let’s take a look at some of the characteristics and features of unified ledgers.

“‘Unified ledgers,’ an important building block of the Finternet, are a promising vehicle to turn our vision of an efficient future financial system into reality”

Bank for International Settlements, “Finternet: the financial system for the future,” April 15, 2024

Source: BIS

“The ledgers would also include the information necessary for their operation, such as the data required to ensure the secure and legal transfer of money and assets (eg digital identity and laws, regulations and rules governing transactions) as well as real-world information sourced from outside the ledger”

Bank for International Settlements, “Finternet: the financial system for the future,” April 15, 2024

According to the report, unified ledgers are “are digital platforms that bring together multiple financial asset markets – such as for wholesale tokenized central bank money, tokenized commercial bank deposits and other tokenized assets, including company shares, corporate or government bonds and real estate, to name just a few – as executable objects on common programmable platforms.”

In one sentence, we see how unified ledgers can facilitate the use of CBDCs (tokenized central bank money) on programmable platforms.

The report also highlights how “BIS Innovation Hub projects have focused on connecting existing systems and new ones such as central bank digital currencies (CBDCs)” in a section called “contributions from the BIS Innovation Hub to an architecture for unified ledgers.”

And digital identity is central to everything. Read Full Article >